Condo Insurance in and around Owings Mills

Looking for excellent condo unitowners insurance in Owings Mills?

Condo insurance that helps you check all the boxes

Home Is Where Your Condo Is

When you think of "home", your condo is first to come to mind. That's your retreat, where you have made and are still making memories with your people. It doesn't matter what you're doing - cooking, unwinding, playing - your condo is your space.

Looking for excellent condo unitowners insurance in Owings Mills?

Condo insurance that helps you check all the boxes

Agent Martina Hendon, At Your Service

We understand. That's why State Farm offers excellent Condo Unitowners Insurance that can help protect both your unit and the personal property inside. Agent Martina Hendon is here to help you understand your options - including benefits, savings, bundling - helping you create a customizable plan that provides what you want.

Ready to get going? Agent Martina Hendon is also ready to help you explore what customizable condo insurance options work well for you. Call or email today!

Have More Questions About Condo Unitowners Insurance?

Call Martina at (410) 744-8333 or visit our FAQ page.

Simple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

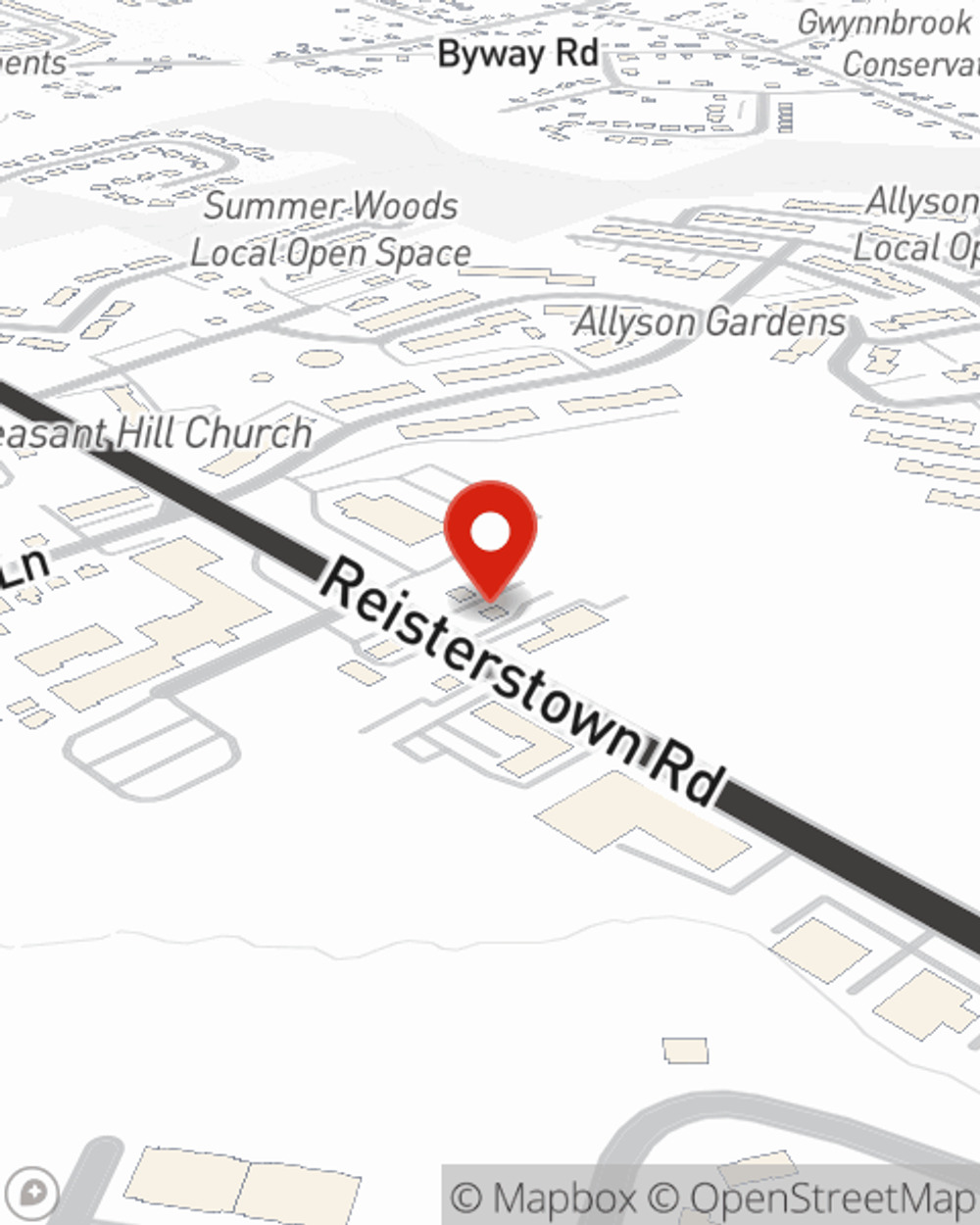

Martina Hendon

State Farm® Insurance AgentSimple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.